Returning NRIs and Foreign Assets: RBI Rules, Accounts & FEMA Clarity

Can you keep your foreign bank account, property, and investments after returning to India? Yes! FEMA Section 6(4) allows you to retain foreign assets acquired during NRI status. Learn the complete rules, account conversion requirements, and tax compliance steps.

Returning NRIs and Foreign Assets: RBI Rules, Accounts & FEMA Clarity

Understanding FEMA Section 6(4), bank account conversions, and compliance requirements for returning NRIs.

Key Takeaways:

- You can legally retain foreign bank accounts, property, and investments after returning to India under FEMA Section 6(4)

- NRE/NRO accounts must be converted to resident or RFC accounts within a reasonable timeframe

- No RBI approval needed for assets acquired during NRI status, but tax disclosure is mandatory once you become ROR

- RNOR status provides temporary relief from global taxation, but ROR status requires full foreign asset reporting

- 31% of returning NRIs are misinformed about their rights, leading to costly compliance mistakes

Can You Keep Your Foreign Assets After Returning to India?

Imagine this: You've spent 15 years building a life in the US. You own a home in California, have a healthy 401(k), maintain checking and savings accounts, and hold investments in US stocks. Now you're planning to return to India permanently. The question that keeps you up at night: Do I have to liquidate everything and bring all my money back to India?

You're not alone. This is the single biggest financial concern for returning NRIs. The fear of losing access to foreign assets, facing penalties, or making costly compliance mistakes creates real anxiety.

Here's the good news: India's Foreign Exchange Management Act (FEMA) provides clear rules through Section 6(4). You can legally retain foreign property, bank accounts, and investments acquired while you were abroad. But here's the catch — many NRIs still misunderstand the rules, especially around compliance with the Reserve Bank of India (RBI) and income tax reporting.

In this comprehensive guide, you'll learn exactly what happens to your foreign assets when you return to India, how to stay compliant with FEMA and RBI regulations, and the critical steps you must take to avoid penalties.

What is FEMA Section 6(4) and Why Does It Matter?

FEMA Section 6(4) is the legal foundation that protects your right to retain foreign assets after returning to India. This provision was specifically designed to address the concerns of returning NRIs who had built financial lives abroad.

Under FEMA Section 6(4), once you return to India, you are legally permitted to continue holding:

- Foreign bank accounts: Checking, savings, and investment accounts opened during your NRI status

- Immovable property abroad: Residential homes, commercial real estate, and land purchased while you were a non-resident

- Foreign investments: Stocks, mutual funds, bonds, ETFs, and retirement accounts like 401(k) or IRA

- Income from these assets: Rental income, interest, dividends, and capital gains generated from foreign assets

In January 2014, the Reserve Bank of India issued a landmark clarification (AP Series Circular No. 90) to eliminate ambiguity. It confirmed that returning NRIs can freely retain and use foreign assets without RBI approval, provided they were acquired while the person was a non-resident.

Bottom line: You don't need to rush to close accounts or sell property abroad when you move back. You can continue to hold, use, and even reinvest in these assets. The key requirement is that you acquired them legitimately during your NRI status.

This is a huge relief for returning NRIs who want to maintain financial flexibility and diversification across borders. However, while FEMA allows you to keep these assets, there are still important compliance requirements you must follow — especially around bank account conversions and tax reporting.

Where the Confusion Comes From

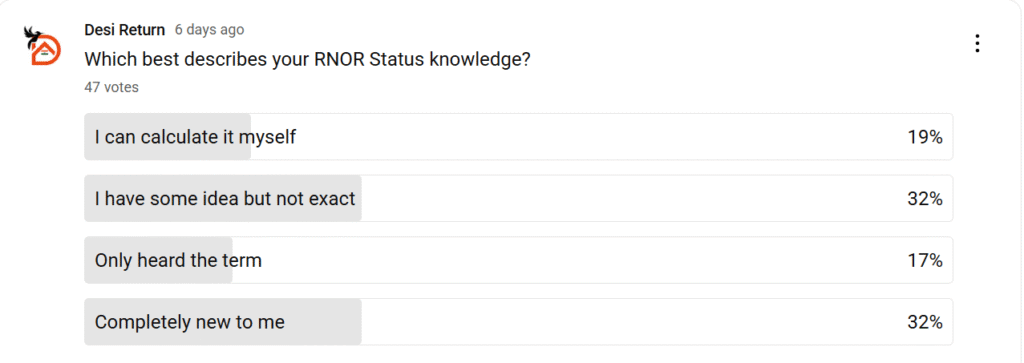

Despite the law being clear, many NRIs are still unsure about compliance. To test this, we ran a poll in the Desi Return community asking:

Here's how 80 respondents voted:

- 10% believed they must close everything and bring money back.

- 15% thought they could keep assets but only with RBI approval.

- 69% correctly said they can freely retain and use assets acquired abroad.

- 6% admitted they were not sure at all.

This shows that while a majority are somewhat aware, 1 in 3 returning NRIs are still either misinformed or completely unsure. That gap often leads to compliance mistakes, unnecessary asset transfers, or missed tax disclosures.

Our poll revealed that 31% of returning NRIs are either misinformed or uncertain about their rights. This is exactly where costly mistakes happen — like not converting accounts, failing to disclose assets on time, or unnecessarily liquidating investments abroad.

Need Help with Compliance?

If you're returning to India and unsure about compliance, our team can help with:

- Regulatory Compliance: FEMA declarations, RBI rules, asset retention.

- Tax Filings: Reporting foreign income, avoiding double taxation.

- KYC Updates: Seamless conversion of NRE/NRO/FCNR accounts.

We'll connect you with experts who specialize in cross-border regulatory compliance for NRIs.

What Happens to Your NRE, NRO, and FCNR Accounts After Returning to India?

Here's where things get tricky. While FEMA Section 6(4) allows you to keep your foreign bank accounts (like your US checking account or UK savings account), your Indian NRI accounts cannot remain the same once you move back.

This is a critical distinction that many returning NRIs miss. Your NRE (Non-Resident External) and NRO (Non-Resident Ordinary) accounts were opened specifically for non-residents. Once you become a resident of India, these accounts must be converted.

How to Convert Your NRI Accounts: Step-by-Step Guide

| Account Type | What Happens After Return | Timeline |

|---|---|---|

| NRE Accounts | Must be converted into resident savings accounts or RFC (Resident Foreign Currency) accounts. Funds remain fully repatriable. | Within a reasonable period (typically 3-6 months) |

| NRO Accounts | Typically converted into resident savings accounts. Repatriation limits apply ($1 million per financial year). | Within a reasonable period (typically 3-6 months) |

| FCNR Deposits | Can be held until maturity date. After maturity, funds must be converted to resident accounts or RFC accounts. Cannot be renewed. | Hold until maturity, then convert immediately |

| RFC Accounts | Ideal for returning NRIs who want to park foreign income in foreign currency without immediate INR conversion. Maintains currency diversification. | Can be opened immediately upon return |

⚠️ Critical: This conversion is not optional. Banks require KYC updates and a formal declaration of your residential status. Failing to convert your accounts can result in penalties, account freezing, or even legal action under FEMA regulations.

The conversion process typically takes 2-4 weeks and requires you to submit proof of return to India (such as a cancelled visa, employment letter, or residential address proof). Most major banks like ICICI, HDFC, and SBI have streamlined online processes for this conversion.

If you're planning your return and want to understand the complete process of NRI bank account closure and conversion, we've created a detailed guide that walks you through every step.

The Confusing Reality: How is "Residency" Actually Defined?

Here's where things get complicated. The definition of "resident" is not the same across different Indian laws. This creates a gray area that can trip up even the most diligent returning NRIs.

Two Different Definitions of Residency

Income Tax Act Definition

Objective and mechanical: You're a resident if you stay in India for ≥182 days in a financial year, OR 60+ days in the current year plus 365 days in the previous 4 years. This is a clear, day-counting approach.

Source: Income Tax Department of India

FEMA Definition

Intent-based and subjective: If you've returned to India with the intention of staying indefinitely (not just for a visit), you're treated as a resident from day one — regardless of how many days you've actually spent in India.

Source: Reserve Bank of India

Why this matters: A recent Income Tax Appellate Tribunal (ITAT) ruling created even more confusion by applying the stricter Income Tax definition under FEMA regulations too. This means the "intent-based" FEMA definition might not always apply, and you could be judged by the day-counting method instead.

Until clearer guidelines emerge from the RBI or the Ministry of Finance, returning NRIs should carefully track both definitions to stay compliant. The safest approach is to assume you're a resident under both laws from the day you return with the intention to stay permanently.

This ambiguity is exactly why many returning NRIs work with chartered accountants who specialize in cross-border taxation. If you're unsure about your residency status and how it affects your NRI tax planning and RNOR vs ROR status, professional guidance can save you from costly mistakes.

How Do You Report Foreign Assets in Your Income Tax Return?

This is where FEMA rules and income tax rules intersect — and where many returning NRIs make costly mistakes. While FEMA allows you to keep your foreign assets, the Income Tax Department has strict disclosure requirements.

Understanding Your Tax Status: RNOR vs ROR

RNOR Status (Resident but Not Ordinarily Resident)

If you qualify as RNOR, you get temporary relief. You don't have to declare foreign assets immediately in Schedule FA. Your foreign income (like US rental income or dividends) is not taxable in India during this period.

Who qualifies: You're RNOR if you've been a non-resident in 9 out of the previous 10 financial years, OR you've been in India for less than 730 days in the previous 7 years.

Duration: RNOR status typically lasts 2-3 years after your return, depending on your specific situation.

ROR Status (Resident and Ordinarily Resident)

Once you become ROR, everything changes. You must report ALL foreign assets in Schedule FA of your Income Tax Return. This includes bank accounts, property, investments, signing authority on foreign accounts, and beneficial ownership interests.

What to report: Foreign bank accounts (even with zero balance), foreign property, foreign stocks/mutual funds, foreign life insurance, foreign retirement accounts (401k, IRA), and any other foreign financial interests.

Taxation: Your global income becomes taxable in India. This includes foreign rental income, interest, dividends, and capital gains.

Penalties for Non-Disclosure

Non-reporting of foreign assets can lead to severe penalties under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015. Penalties can be as high as ₹10 lakh per violation, plus potential prosecution.

Important: Even if you don't owe any tax (due to Double Taxation Avoidance Agreements), you still must disclose all foreign assets in Schedule FA.

Key takeaway: While FEMA lets you keep your assets, income tax law eventually requires full disclosure and taxation once you become ROR. The transition from RNOR to ROR is when most compliance mistakes happen.

Many returning NRIs benefit from working with a CA who specializes in international taxation to ensure proper reporting and to take advantage of tax treaties between India and your previous country of residence. If you need help with Schedule FA filing and foreign asset disclosure requirements, our network of experts can guide you through the process.

Your Action Plan: 7 Steps to Stay Compliant After Returning to India

Now that you understand the rules, here's exactly what you need to do to stay compliant and avoid penalties:

- Determine your residency status: Calculate whether you're NR, RNOR, or ROR under both FEMA and Income Tax Act. This determines your compliance obligations.

- Notify your Indian banks immediately: Inform all banks where you hold NRE/NRO/FCNR accounts about your return. Start the conversion process within 3-6 months.

- Update KYC documents: Submit proof of return (cancelled visa, employment letter, address proof) to all financial institutions.

- Maintain documentation: Keep records proving when and how you acquired foreign assets (purchase agreements, bank statements, investment confirmations). This protects you under FEMA Section 6(4).

- Plan your tax strategy: Understand your RNOR period and plan for the transition to ROR status. Consider tax-efficient repatriation strategies.

- File Schedule FA correctly: Once you become ROR, ensure complete and accurate reporting of all foreign assets in your ITR. Don't skip anything.

- Consult specialists: Work with a CA or legal advisor who specializes in NRI taxation and FEMA compliance. The cost of professional help is far less than the cost of penalties.

If you're also planning to transfer your retirement savings like a 401(k) back to India, make sure you understand the 401k withdrawal rules India tax implications to avoid unnecessary tax hits.

Need Professional Guidance?

If you need a professional CA to guide you through this process, we can connect you with experts who specialize in NRI taxation and compliance.

Get Expert Help with Your NRI to Resident Transition

Join over 21,000+ families who are making their return smoother with DesiReturn.

Get personalized guidance on FEMA compliance, tax planning, and account conversions.

Frequently Asked Questions

Loading comments...