Moving Back to India? Here's Why RNOR Status Matters More Than You Think

Moving back to India? RNOR status could save you thousands in taxes. This transitional status protects your foreign income from Indian taxation for 2-3 years. Learn how to qualify, maximize benefits, and avoid costly mistakes when returning home.

Moving Back to India? Here's Why RNOR Status Matters More Than You Think

Understanding RNOR status, eligibility rules, tax benefits, and how to maximize this transitional period when returning to India.

Key Takeaways

- RNOR status protects your foreign income from Indian taxation for 2-3 years after returning

- You qualify if you were NRI for 9 of last 10 years OR stayed ≤729 days in India over last 7 years

- During RNOR years, you don't need to report foreign assets in Schedule FA

- 70% of returning NRIs don't fully understand RNOR, leading to costly tax mistakes

- Plan your transition carefully before RNOR expires and you become fully taxable on global income

Why RNOR Status Could Save You Lakhs in Taxes

Imagine this: You've spent 8 years building your career in the US, saved diligently, and now you're ready to move back to India. But here's what 70% of returning NRIs don't realize — the moment you become a resident, India can tax your global income. That foreign salary, those US investments, your 401(k) — all potentially taxable. One family we worked with nearly paid ₹8 lakhs in unnecessary taxes because they didn't understand RNOR status.

Unless you understand RNOR status.

Every year, thousands of NRIs plan to move back to India. For many, the biggest concern is not just about adjusting socially, but financially. One of the least understood yet most critical aspects of this transition is your RNOR status (Resident but Not Ordinarily Resident).

This special category under the Indian Income Tax Act ensures that returning NRIs don't face sudden and unfair tax liabilities. However, confusion around RNOR rules, eligibility, and benefits is widespread — and the risks of getting it wrong are costly.

What Is RNOR Status? Your Tax-Saving Bridge Period

RNOR stands for Resident but Not Ordinarily Resident. It's a transitional residential status recognized by the Income Tax Act, 1961.

When you return to India after living abroad, you don't immediately become a Resident and Ordinarily Resident (ROR). Instead, if you meet specific conditions, you are classified as RNOR for a limited time.

Think of RNOR as a bridge between your NRI life and full Indian residency. During this period, you get the best of both worlds — you're technically a resident for visa and banking purposes, but your foreign income remains protected from Indian taxation.

This middle category ensures your foreign income is not taxed in India right away, while you adjust financially and legally to residency.

How Do I Qualify for RNOR Status? The Simple Test

You don't need to apply for RNOR status — it's automatically determined when you file your income tax return. Your RNOR eligibility is based on two simple tests. You only need to pass ONE of them:

Test 1: The 729-Day Rule

- You must have stayed in India 729 days or less in the last 7 financial years

This test looks at your physical presence in India over the previous 7 years. If you've been working abroad and only visited India occasionally, you'll likely pass this test.

Test 2: The 9-Year Rule

- You must have been an NRI for 9 out of the last 10 financial years

This test looks at your tax residency status. If you've been classified as NRI for at least 9 of the previous 10 years, you qualify as RNOR.

If either of these conditions is met, you qualify as RNOR. Most returning NRIs who've worked abroad for 5+ years automatically qualify.

Real Example: How RNOR Calculation Works

Let's say Priya worked in Singapore from 2018 to 2025 and returns to India in FY 2025–26:

- She stayed only 500 days in India during the last 7 years (visiting family during holidays)

- She was an NRI for 9 of the last 10 years

✅ Priya qualifies as RNOR for FY 2025-26.

Her Singapore salary and investments remain tax-free in India during her RNOR years. She can use this time to restructure her finances, convert accounts, and plan for eventual full residency.

If, however, she had exceeded 729 days in India OR was resident in more than 2 of the last 10 years, she would become Resident and Ordinarily Resident (ROR) immediately — making her global income taxable in India.

What Are the Tax Benefits of RNOR Status?

The biggest reason NRIs must understand RNOR is its tax benefits. Here's what you can save during your RNOR years:

1. Foreign Income Remains Tax-Free

Your foreign salary, rental income from overseas property, dividends from US stocks, and capital gains from foreign investments are NOT taxed in India (unless received directly in India). This is the biggest benefit of RNOR status.

2. NRE and FCNR Deposits Stay Tax-Exempt

Interest earned on your NRE and FCNR accounts continues to enjoy tax exemptions during RNOR years. You don't need to immediately convert these accounts to resident accounts.

3. No Foreign Asset Reporting Required

Unlike ROR status, RNORs don't need to report foreign assets in Schedule FA of their Income Tax Return. Your foreign bank accounts, property, and investments remain private during RNOR years.

4. DTAA Benefits Still Apply

Double Tax Avoidance Agreements to avoid double taxation can still apply, reducing double taxation risks on income that might be taxable in both countries. This is especially important if you're earning income from multiple countries during your RNOR period.

5. Time to Restructure Your Finances

RNOR gives you 2-3 years to strategically restructure investments and assets before becoming a full resident. You can plan your best options for your 401(k) funds when moving to India, understand what to do with your 401(k) after leaving the U.S., repatriate funds efficiently, and optimize your tax position.

In essence, RNOR status acts as a buffer zone — allowing you time to plan without being taxed on global income. This can save you lakhs of rupees in taxes if planned correctly.

RNOR vs NRI vs ROR: What's the Difference?

Understanding the three residency statuses is crucial for tax planning. Here's how they compare:

| Category | Definition | Tax Implication | Foreign Asset Reporting |

|---|---|---|---|

| NRI | Non-resident under the Income Tax Act | Foreign income not taxed in India | Not required |

| RNOR | Transitional resident status for returning NRIs | Only Indian-sourced income taxed; foreign income largely exempt | Not required |

| ROR | Full resident under Indian tax law | Global income taxable in India | Mandatory (Schedule FA) |

This comparison shows why RNOR is highly valuable — it gives returning NRIs breathing room to align finances. You get the legal status of a resident (for banking, visas, etc.) while maintaining the tax benefits of an NRI.

Pro Tip: Many returning NRIs don't realize they're RNOR and file taxes as ROR, paying unnecessary taxes on foreign income. Always check your eligibility before filing your first return after moving back. This is especially important when planning your 401(k) withdrawal strategy during RNOR years.

How Long Does RNOR Status Last?

Here's what many returning NRIs get wrong: RNOR is not a one-time approval or a fixed status. Your RNOR status is determined each year at the time of filing income tax, based on the residential status criteria in the Income Tax Act — not a fixed approval from the CBDT.

In practice, an individual can typically be classified as RNOR for a maximum of 2–3 financial years after returning to India. After this period, if you no longer meet the conditions, you transition into Resident and Ordinarily Resident (ROR) and your global income becomes taxable in India.

Why RNOR Expires After 2-3 Years

Let's understand the math:

- Year 1 after return: You still meet the 9-out-of-10-years test (you were NRI for 9 of the previous 10 years) ✅ RNOR

- Year 2 after return: You still meet the test (8 out of previous 10 years as NRI) ✅ RNOR

- Year 3 after return: You might still qualify depending on your specific timeline ✅ RNOR

- Year 4 after return: You no longer meet the 9-out-of-10 test ❌ You become ROR

Critical Planning Window: Use your RNOR years wisely. Once you become ROR, you cannot go back to RNOR status unless you leave India and become NRI again for several years. This is your window to optimize 401(k) withdrawals, repatriate funds, and restructure investments tax-efficiently.

5 Costly Mistakes Returning NRIs Make with RNOR Status

Based on conversations with thousands of returning NRIs in our community, here are the most expensive mistakes people make:

Mistake #1: Treating RNOR Like NRI Status

Many people believe RNOR = NRI and file taxes incorrectly. While both statuses protect foreign income, RNOR has different rules for Indian income, TDS, and advance tax. Filing as NRI when you're actually RNOR can trigger notices from the Income Tax Department.

Mistake #2: Not Reporting Foreign Assets After RNOR Expires

Once your RNOR status ends and you become ROR, you MUST report all foreign assets in Schedule FA. Many people miss this transition and face penalties up to ₹10 lakh per violation under the Black Money Act. Set a reminder to check your status each year.

Mistake #3: Delaying Account Restructuring

Your NRE and FCNR accounts need to be converted to resident accounts once you're no longer NRI. Many people delay this during RNOR years and face compliance issues. Use your RNOR period to plan this transition strategically. Similarly, if you have Social Security benefits when moving back to India, understand how they're taxed during RNOR vs ROR status.

Mistake #4: Assuming RNOR Lasts Forever

RNOR is temporary — typically 2-3 years. Many returning NRIs don't plan for the transition to ROR status and get hit with unexpected tax bills on foreign income. Start planning your post-RNOR strategy from day one.

Mistake #5: DIY Tax Filing Without Expert Guidance

RNOR taxation involves complex rules around foreign income, DTAA, TDS, and advance tax. Many people try to file themselves and make costly errors. A qualified CA specializing in cross-border taxation can save you far more than their fees.

Each of these mistakes can cost you thousands — or even lakhs — in unnecessary tax payments, penalties, and interest. The good news? They're all preventable with proper planning.

The Shocking Truth: 70% of Returning NRIs Don't Understand RNOR

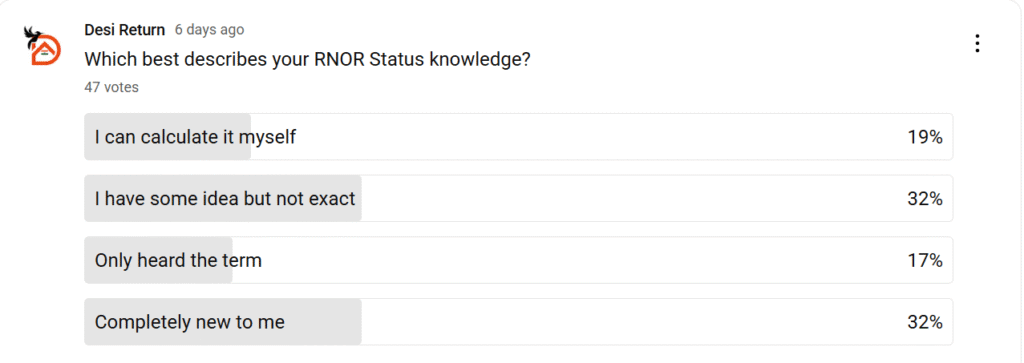

When we spoke to our community of returning NRIs, one thing became clear — most people are still unsure about RNOR status and its benefits. To see how widespread this confusion really is, we ran a quick poll:

Here's how 38 returning NRIs responded:

- 37% – Completely new to RNOR (never heard of it before)

- 34% – Have some idea but not exact (know it exists but unclear on rules)

- 16% – Only heard the term (no understanding of benefits)

- 13% – Confident they can calculate it (fully understand eligibility)

💡 Shocking Reality: Almost 70% of returning NRIs don't fully understand RNOR status. That means many families are either paying thousands in unnecessary taxes — or risking compliance issues with the Income Tax Department.

This tells us something important: while RNOR is designed to make your transition smoother, most NRIs aren't clear on how it works. And that lack of clarity is costing people real money.

Why Is RNOR Status So Confusing for Returning NRIs?

Our poll showed that only 13% could confidently calculate their RNOR status. Why is it so confusing?

Reason #1: Complex Calculation Rules

The Income Tax Act uses two different tests (729 days over 7 years OR 9 out of 10 years as NRI) with overlapping financial years. Most people don't know which test applies to them or how to count the days correctly.

Reason #2: Lack of Awareness

Many CAs in India don't specialize in cross-border taxation and may not fully understand RNOR rules. Even tax software often doesn't handle RNOR cases correctly, leading to wrong filings.

Reason #3: Misleading Peer Advice

People rely on advice from friends and family who "went through it" — but every case is different. What worked for someone who returned from the UK in 2020 may not apply to someone returning from the US in 2025.

Reason #4: RNOR's Temporary Nature

Unlike NRI or ROR status which are relatively stable, RNOR changes every year based on your history. You need to recalculate your status each financial year, which adds complexity.

This is why so many returning NRIs face compliance risks and tax penalties. And this is exactly why planning RNOR properly is so important. It's not just about counting days; it's about understanding how your foreign salary, NRE deposits, pensions, investments, and foreign assets interact with Indian tax law.

Get Expert RNOR Guidance from Specialists

The best way to avoid costly mistakes is by working with a CA who specializes in cross-border taxation. The right guidance can help you:

- Calculate your exact RNOR eligibility and duration

- Maximize RNOR tax benefits and save lakhs in taxes

- Plan your best options for your 401(k) funds when moving to India and fund repatriation strategically

- Navigate financial planning for NRIs returning to India including 401k IRA and Social Security

- Avoid errors in tax filings and Schedule FA reporting

- Transition smoothly into full residency without compliance risks

Should I Use an RNOR Calculator to Check My Eligibility?

For returning NRIs who want to self-check their RNOR status, DesiReturn has built a simple RNOR Status Calculator. It's a good starting point to understand your basic eligibility.

Try the Free RNOR Status Calculator

This tool helps you quickly understand whether you qualify as RNOR based on your days of stay and past residency record. Get an instant preliminary assessment in under 2 minutes.

Important: While a calculator is useful for basic eligibility, it doesn't capture the nuances of foreign income classification, DTAA benefits, TDS implications, or cross-border asset planning. For complete clarity and personalized tax planning, always follow up with expert guidance from a CA specializing in returning NRI taxation.

When to Use a Calculator vs. When to Consult an Expert:

- Use calculator: Quick eligibility check, understanding basic rules

- Consult expert: Tax filing, income classification, asset restructuring, DTAA claims, compliance planning

Your RNOR Action Plan: What to Do Right Now

If you're planning to return to India or recently moved back, here's your step-by-step action plan:

Step 1: Calculate Your RNOR Eligibility (This Week)

- Count your days in India over the last 7 financial years

- Check your residency status for the last 10 financial years

- Use our RNOR calculator for a quick preliminary check

Step 2: Consult a Cross-Border Tax Specialist (This Month)

- Find a CA who specializes in NRI and RNOR taxation

- Get your exact RNOR duration calculated

- Understand which of your income sources are taxable

Step 3: Plan Your Financial Restructuring (First 6 Months)

- Decide when to withdraw from your 401(k) after leaving the U.S.

- Plan conversion of NRE/FCNR accounts to resident accounts

- Optimize timing of foreign income repatriation

- Set up proper documentation for Double Tax Avoidance Agreements to avoid double taxation

- Review your Social Security benefits when moving back to India and understand tax implications

Step 4: File Taxes Correctly (Every Year)

- Recalculate your RNOR eligibility each financial year

- File ITR with correct residential status

- Keep records of days in India and abroad

- Prepare for transition to ROR status

Pro Tip: Start planning your RNOR strategy at least 6 months before your return. The earlier you plan, the more tax savings you can unlock. Many families save ₹5-10 lakhs or more by optimizing their RNOR transition properly.

Common Questions About RNOR Status Answered

Can I claim RNOR status if I visit India frequently?

Yes, you can still qualify for RNOR status even if you visit India frequently, as long as you meet one of the two eligibility tests. The key is counting your total days in India over the last 7 financial years (must be 729 days or less) OR ensuring you were NRI for 9 out of the last 10 financial years. Short visits during holidays typically don't disqualify you.

What happens to my NRE account during RNOR years?

During your RNOR years, you can continue to maintain your NRE account and enjoy tax-free interest. However, technically, once you become a resident (even as RNOR), you should inform your bank about your change in status. Many banks allow you to keep the account operational during RNOR period, but policies vary. It's best to consult with your bank and a tax advisor about the optimal timing for account conversion.

Do I pay tax on my US salary during RNOR years?

If you're earning a US salary while being RNOR in India, the taxation depends on where the income is earned and received. Generally, foreign income earned outside India and not received in India is not taxable during RNOR years. However, if you're working remotely for a US company while physically present in India, the income may be considered India-sourced and taxable. This is a complex area where Double Tax Avoidance Agreements to avoid double taxation come into play, and you should consult a cross-border tax specialist.

Can I lose RNOR status before 2-3 years?

Yes, RNOR status is recalculated every year based on your residency history. If your circumstances change — for example, if you had incorrectly calculated your previous years' residency or if the rules change — you could transition to ROR status earlier than expected. This is why it's crucial to recalculate your status each financial year and maintain accurate records of your days in India.

Should I file taxes as RNOR or wait until I'm sure?

You should file your taxes with the correct residential status (RNOR) as soon as you're eligible. Don't wait or file as ROR "to be safe" — this will result in you paying unnecessary taxes on foreign income. If you're unsure about your status, consult a CA before filing. Filing incorrectly can lead to either overpaying taxes or facing notices from the Income Tax Department.

Plan Your RNOR Transition with Expert Guidance

Join over 21,000+ families who are making their return smoother with DesiReturn. Get personalized guidance on RNOR planning, tax optimization, and financial restructuring.

Connect with tax experts who specialize in RNOR planning and cross-border taxation. Save thousands in taxes with proper planning.